March 12, 2021

Capital Partners’ CPCA COVID Response Loan Fund – Now Accepting Applications through April 30th

Throughout 2020, California’s community health centers (CHCs) faced the COVID-19 pandemic, providing care to their communities despite the difficult circumstances. As a result of business disruptions and reduced client visits, they also experienced significant lost revenue, which could reduce their ability to continue providing quality care. Now in 2021, clinics are faced with new costs and challenges related to vaccination efforts. We are here to help.

To bridge this gap, the California Primary Care Association (CPCA) and Capital Impact Partners along with other funders, including Alliance Healthcare Foundation, are providing flexible financing to California CHCs through the CPCA COVID Response Loan Fund. Applications are now being accepted through April 30, 2021.

Learn About the Fund and How to Apply

Informational Webinar

Join our upcoming webinar to learn more and speak to us about the Fund.

March, 17, 2021; 11 a.m. PDT

Key features of the CPCA COVID Response Loan Fund managed by Capital Impact:

- Loans from $250,000 up to $1.5 million

- 3% interest rate

- No payments until February 1st, 2022, then fully amortizing over 6 years

- Loan will be secured by a general all asset lien. No real estate collateral required

- Each borrower will automatically receive a grant for technical assistance and COVID-19 related expenses

- No fees associated with loan closing

- No prepayment penalty

- Prohibited Uses:

- Retirement of debt, including other Capital Impact Partners and CPCA Ventures-related debt

- Development of new permanent sites

- Renovations or improvements unrelated to COVID-19 pandemic response

Eligible uses include any working capital need resulting from the COVID-19 pandemic. Uses include, but are not limited to:

- Operating revenue shortfalls or temporary increases in expenses including temporary staff

- Renovations for social distancing, testing and vaccinations, and other COVID related needs

- Telemedicine infrastructure

- Critical system upgrades to support uninterrupted care including, HVAC, IT Systems, and power supply

- Temporary or mobile clinic space related to COVID testing, treatment, and vaccination

Eligible Organizations:

- Nonprofit health centers – including non-CPCA members – licensed in the state of California under Section 1204 of the California Health and Safety Code are eligible and encouraged to apply. These organizations include but are not limited to, Federally Qualified Health Centers (FQHCs), FQHC-Look-Alikes, rural health clinics, Indian Health Clinics, free clinics, etc.

- Nonprofit consortiums with a majority membership comprised of the nonprofit health centers described above

- Health centers located on land recognized by the United States government as tribal land in California and operated by an Indian tribe recognized by the United States government

Applying organizations must also have been in operation for a minimum of three years and demonstrate negative operational impact resulting from the COVID-19 pandemic.

Timeline:

The goal is to make loan decisions before the end of May 2021 and fund loans before the end of June 2021. Further details about Fund terms can be found online here.

Have Questions?

If you have additional questions about the Fund or application process, please visit our website for details about our informational webinar, FAQs, and contact information of fund managers.

Related News

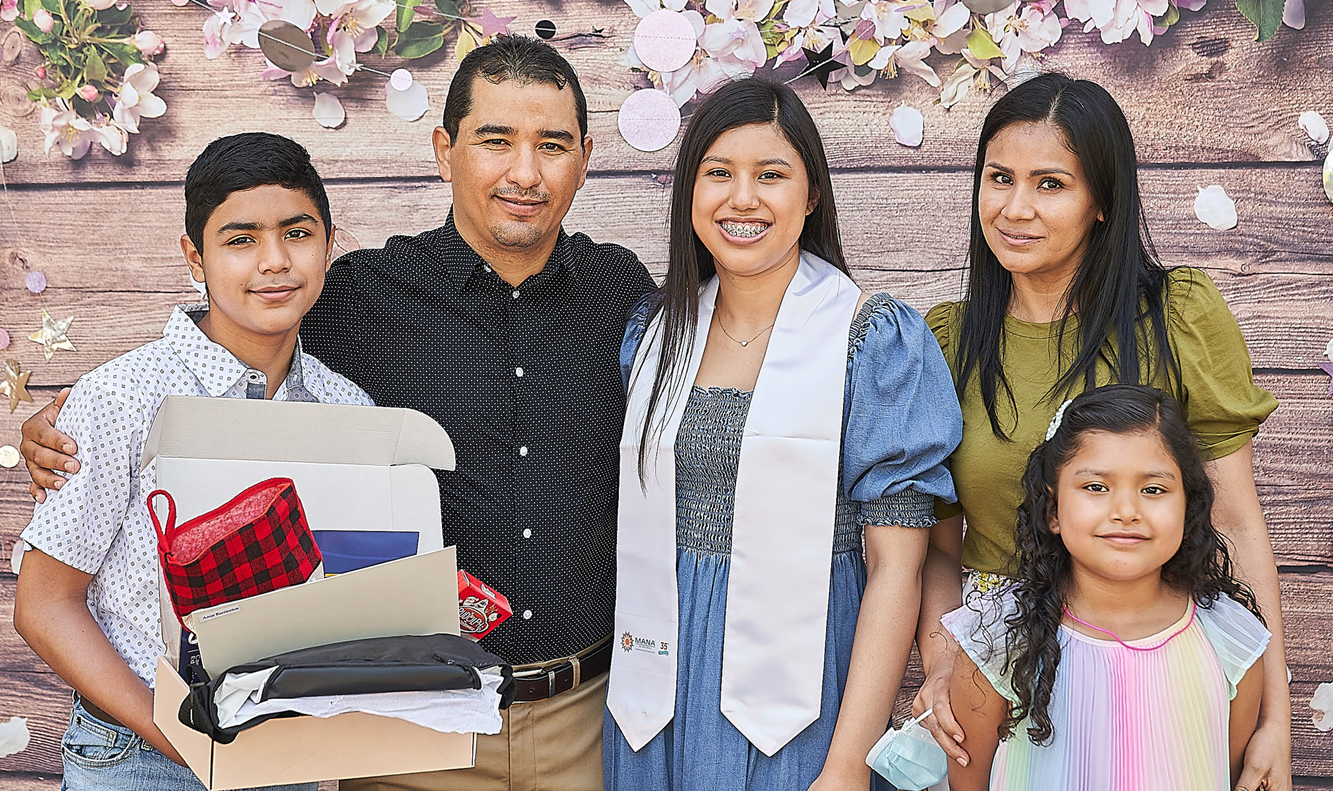

Jul 24, 2024

July 2024

Supporting Youth It’s time for Back-to-School readiness and several […]

Jul 9, 2024

Celebrating 5 Years with Sarah Lyman

Leading AHF through Great Periods of Growth As we close […]

Jun 27, 2024

AHF funding wealth generation for low-income Latinas

Latina Upward Mobility Initiative (LUMI) Workforce development and guaranteed income […]